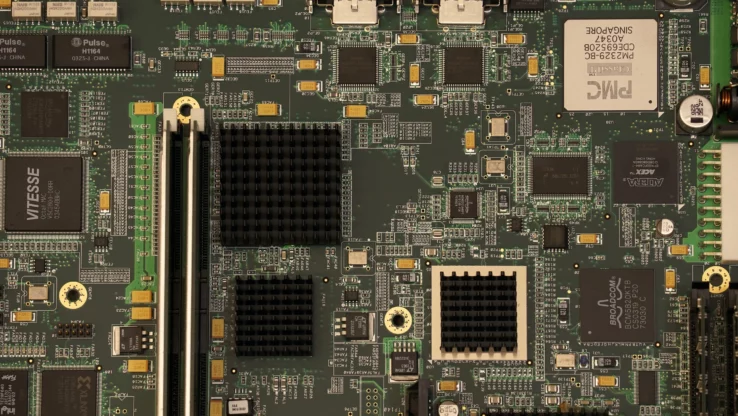

The Semiconductor Industry in Q4: Booming but Facing Bottlenecks

20. December 2023

The fourth quarter of 2023 is marked by conflicting developments in the semiconductor industry: sales are rising, but the shortage of skilled workers is worsening. What does the future hold for the industry?

For the semiconductor industry, 2023 was a rollercoaster ride. The first half of the year was overshadowed by the lingering effects of the pandemic, ongoing trade disputes, and supply chain disruptions. However, as we approach the year’s end, there is a noticeable shift towards recovery. The latest SEMI report highlights a significant rebound in electronics sales, showing a 22% increase over the previous quarter.

The analysts expect non-storage investments to exceed storage investments in 2023. The total investment is projected to reach the level seen in the fourth quarter of 2020. “While semiconductor markets have been declining year-over-year for the past five quarters, growth is expected to resume in the fourth quarter of 2023 as production cuts in the supply chain have taken hold,” said Boris Metodiev, Director of Manufacturing Analysis at TechInsights. Therefore, production cuts have helped rebalance supply and demand, potentially leading to revenue growth.

Skill Shortage Dampens Euphoria

However, the semiconductor industry is also facing a number of challenges that could affect its competitiveness. One of the biggest is the shortage of skilled workers, which has worsened in recent years. A study by the German Economic Institute shows that the shortage of skilled workers in the industry has increased by 30 percent to over 82,000. This shortage not only hinders the establishment of new chip factories in Germany but could also limit the industry’s ability to produce and innovate.

Weakness in Key Indicators

The industry faces notable challenges, especially in manufacturing capacity utilization and capital investment. A report from Electronics Specifier highlights that these crucial indicators have seen a downturn in the latter half of the year, signaling growing uncertainty within the industry. Notably, there was a decline in capacity utilization, dropping from 87.6% in the first quarter to 83.4% in the third. Similarly, capital investment experienced a reduction, falling from $69.9 billion in the first six months to $64.8 billion in the latter half of the year.

But it is not all bad news. A positive development has emerged in the field of back-end equipment billings, which are essential for the assembly, packaging, and testing of semiconductors. This segment saw an encouraging 9.4% increase in billings over the previous quarter, hinting at a potential stabilization in this area. This uptick is largely attributed to a surge in demand for advanced packaging technologies, which are crucial for enhancing semiconductor performance and integration.

Developments at Leading Companies

IT Times has recently covered some significant developments among top players in the semiconductor industry. A notable highlight is the expanded partnership between Apple and Amkor, one of the world’s largest providers of semiconductor packaging and test services. The companies have agreed to collaborate on advanced chip packaging for the next generation of iPhones, iPads, and MacBooks, highlighting the critical role of packaging in enhancing semiconductor performance.

In contrast, some other leading companies have experienced a decline in revenue. Ambarella, a leader in video and imaging solutions, faced an 8% sequential decline in revenue. Similarly, Marvell Technology, known for its storage, networking, and connectivity solutions, saw its quarterly revenue decline by 5%.

To summarize, the semiconductor industry is at a crucial point in the fourth quarter of 2023. Although there are signs of recovery, challenges like skill shortages and weaknesses in key performance metrics persist. The recent developments at these leading companies emphasize that adaptability and innovation are essential for success in the dynamic semiconductor industry.