Challenges for the Global Supply Chain: Natural Disasters, Geopolitical Conflicts, and the Semiconductor Industry

23. January 2024

A powerful earthquake in Japan, sea blockades in the Red Sea by Houthi rebels, and geopolitical tensions in Asia raise questions about the resilience and flexibility of supply chains.

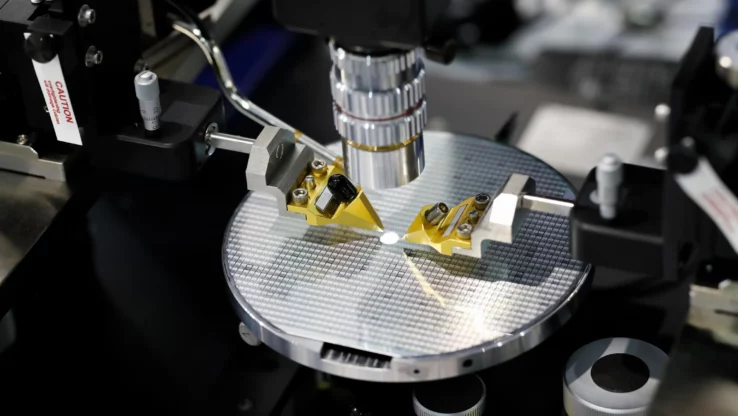

Earthquake in Japan and the Resilience of the Semiconductor Industry

The recent severe earthquake in the Noto region of Ishikawa Prefecture, Japan, temporarily disrupted production at major companies such as Taiyo Yuden, Murata, TDK, Shin-Etsu, Globalwafers, Toshiba, and TPSCo. The temporary closure of the factories was necessary to assess potential damages.

Murata has resumed production in 8 facilities, but potential damages to housings for high-voltage multilayer ceramic capacitors (MLCCs) could impact the supply. The US-Japan Council (USJC) reports a significant decline in Logic IC production. Toshiba announced expected delivery delays of 1-4 months for Power Management ICs (PMICs) and Logic ICs. Furthermore, the closure of the Toshiba/Kioxia NAND factory could lead to a shortage of NAND flash ICs, negatively affecting products such as MP3 players, digital cameras, and smartphones.

Maritime Blockades in the Red Sea: Threat to the Global Economy

The trade route through the Red Sea has always been of global importance, but in recent weeks, a dangerous development significantly affected maritime traffic. Houthi rebels not only declared war on Israel but also influenced international trade.

Numerous attacks on ships with drones and rockets have reduced container traffic in the Suez Canal by 90 percent. Leading shipping companies like Maersk, Hapag-Lloyd, and Evergreen have announced rerouting their ships around South Africa, avoiding the Red Sea. Uncertainties in the Red Sea force companies to switch to safer options. The decisions of shipping companies not only impact the shipping industry but also have significant effects on the global economy, as approximately 12 percent of world trade usually flows through the Red Sea.

The economic impacts are already evident, particularly in container prices, which have increased by over 300 percent since November. This surge results from longer transit times and additional costs for personnel, fuel, and insurance.

According to Sky News reports, the extra costs have not yet directly affected end consumers but could be passed down the supply chain in the coming weeks and months. Yuvraj Narayan, CFO of port and logistics operator DP World, warned that rising costs for goods from Asia will affect European consumers. Similar conflicts and disorder on the high seas are also observed in other regions such as the Black Sea, the East and North Seas, as well as in Asia. Climate change is altering the geography and incentives in maritime trade, with the Panama Canal facing water shortages. Global maritime trade, constituting approximately 16 percent of the world’s gross domestic product (GDP), is confronted with challenges that demand an adaptation of the flexible shipping system. The maritime industry must not only address current challenges but also be prepared for future changes.

Geopolitical Tensions in the Asian Region and Taiwan’s Role in the Semiconductor Industry

Bloomberg considers a Chinese invasion or blockade of the Taiwan Strait as possible scenarios that would have significant impacts on the global GDP, especially in the semiconductor industry. With the election of Lai Ching-te as the new president, representing the Democratic Progressive Party (DPP) and advocating for Taiwan’s independence from China, the political landscape has shifted. Immediately after his election, Lai emphasized the importance of peace in the Taiwan Strait for global stability and called on China to preserve it.

Companies like Taiwan Semiconductor Manufacturing Co. (TSMC) are leaders in this sector and play a crucial role in the global economy. Disruption to the semiconductor supply chain in Taiwan would extend far beyond the region and could lead to trade sanctions, tariffs, interruptions in shipping, and impacts on financial markets.

Overall, it is evident that today’s world economy faces diverse risks. Only through proactive measures and the implementation of effective strategies can companies successfully navigate these complex challenges.